Health Care Decoded

If you find the world of health insurance to be confusing, you’re not alone. Many people have a difficult time sorting through the buzzwords and terminology to figure out exactly what they need to know about their health insurance coverage. We’ve rounded up some of the top health insurance terms you’re likely to hear. And we’ve broken them down to explain what they really mean. It’s health care – decoded.

Click any of the terms below to jump right to the information you need:

Deductible

Copayment

Coinsurance

Out-of-pocket maximum (OOP max)

Formulary

Explanation of Benefits (EOB)

Prior Authorization

Funding Accounts

Premium

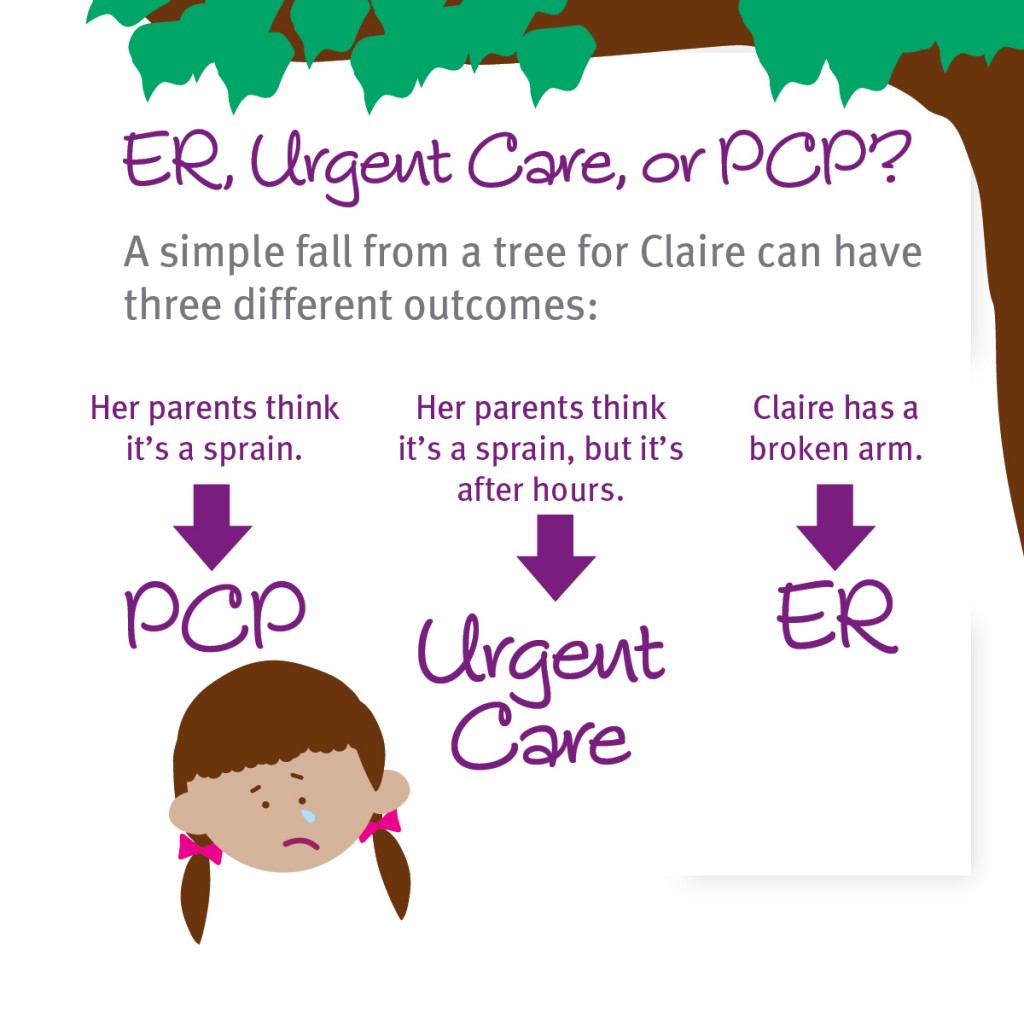

ER, Urgent Care, or PCP?

Have a health insurance term we haven’t covered? Ask us about it.

Many health insurance plans today have something called a deductible, which is the amount you must pay for covered health care services before your health insurance company begins to pick up the tab. If your cost exceeds that amount, your plan will cover the remainder, or a percentage of the remainder. (If you’re in the process of choosing a health insurance plan, it is useful to know that plans with higher deductibles tend to have lower premiums.

Your copay is the set amount that you pay for a health care service, like a doctor visit, or a trip to urgent care. The amount depends on your plan and the type of service you receive. Return to top.

Keep in mind that if your plan has a deductible, you may be responsible for meeting your deductible first. Then, your copay will take effect. In addition, prescription medications also require copays, and they will vary depending on the medication and formulary. Return to top.

Coinsurance is the percentage of the bill you pay for a covered product or service. Unlike a copay, which is a flat amount, coinsurance is based on the cost of the service.

If your health plan has a deductible, the coinsurance is the amount you’re responsible for after your deductible is met. If you receive services from an out-of-network doctor, you may be responsible for additional charges above the coinsurance.

The bottom line: deductibles, copays, and coinsurance are all terms that add up to how much you owe. Get details on how much health insurance costs you. Return to top.

Many people don’t realize that every health insurance plan sets a maximum for the amount you will have to pay, referred to as the out-of-pocket maximum (OOP max). Once you have reached your OOP max, your health insurance company will begin to pay 100% of your costs for covered care. Different plans have different OOP maximums. Return to top.

A drug formulary is a list of prescription drugs your insurance company will pay for, based on the efficacy, safety, cost-effectiveness, and overall value of the drug. A formulary is typically divided into three tiers, with varying copay amounts (Tier 1 with the lowest and Tier 3 with the highest).

Knowing and understanding your formulary is important for several reasons. First of all, it’s important to establish whether the drug being prescribed is covered. Once you have determined a drug is covered, understanding your formulary will allow you to ask your doctor the questions to get the most effective medication possible – for your health and your wallet. Return to top.

At first glance, it may appear to look like a bill – it’s not. An EOB is a statement from your health insurance company after you receive a health treatment or service. It tells you how much the doctor charged, how much your insurance allowed, how much your insurance paid, and the amount you may owe. Return to top.

Sometimes your health insurance plan requires that certain medical services are approved prior to your receiving them. This is called pre- or prior authorization, prior approval, or precertification. It allows your health insurance company to ensure that the care you are receiving is medically appropriate and delivered at the appropriate location. Return to top.

FSAs, HRA, and HSAs are all types of funding accounts, and they can help you save money when it comes to your out-of pocket medical expenses.

A health reimbursement arrangement (HRA) allows employers to set up and fund accounts that will reimburse employees for certain qualified medical expenses. It is owned by your employer, so if you leave your job, the account (and money in it) does not go with you.

A flexible spending account (FSA) allows employees to set aside pre-tax dollars for specific, qualified health and/or dependent care expenses. The money is deducted directly from the employee’s paycheck and is not subject to payroll taxes.

A health savings account (HSA) is owned by the individual (not by the employer) and can be used to pay for qualified medical expenses without federal tax penalty. Unlike an HRA, because it is not owned by your employer, if you leave your job, the account (and money in it) goes with you. Return to top.

A premium is the amount that must be paid for your health insurance or plan. It is, essentially, your bill for your health insurance – which could be due monthly, quarterly, or yearly. It’s a bill you may or may not see, depending on the type of health insurance you have. Return to top.

While you may be familiar with the terms emergency room (ER), urgent care, and primary care physician (PCP), do you know which to visit for a health issue – and when? Deciding the best course of action can be critical in getting you the most effective care for your medical needs. A PCP knows your medical history and can treat you with your unique health needs in mind, while an urgent care can be very convenient when your doctor’s office is closed. Of course, the ER is the best option when immediate care is needed.

Making the right choice can also save you money. While you should always go to the ER for serious health emergencies, visiting your PCP will cost less and is a cost-effective option under normal circumstances. Return to top.

Want more health insurance resources?

Have a health insurance term we haven’t covered?

Sign up to receive some of our most valuable and practical health insurance resources – all designed to make the information you need accessible and easy to understand.

The Daily Dose

The Daily Dose

Alexa Kerins

Alexa Kerins

Mary Provost

I found this information to be very informative and valuable.

John

Thanks for this definitions of terms. I’m just out of college so I need to get my own insurance. I’ll have to look out for the “deductible”; like you said it’s how much I’m responsible for before my insurance kicks in.

Jennifer Brett-Hargis

Hi, John! So glad you found the blog useful. Please let us know if you have any questions as you research your health insurance options.

Angela Griffin

Need insurance please

Natalia Burkart

Hi, Angela – Thanks for reaching out! Please check out our available health plans here: https://plans.cdphp.com.

Anonymous

Thank you for this. It has been very helpful with understanding my plan.

Alexa Kerins

Thanks for the feedback. So happy we could help!