Saving for Your Health Care Future

We save money for cars, homes, and our kids’ education. We even save up for family vacations, home repairs, and holiday shopping. In today’s world, we have accepted the fact that these big-ticket items require some thought, some pre-planning, and some budgeting. One thing we are not accustomed to is budgeting and saving for health care, mainly because we’ve never had to.

Until recently, the majority of Americans paid their monthly insurance premium and the occasional modest copay. We didn’t worry about the actual cost of a doctor’s visit because the insurance company usually covered it. Unfortunately, the days of a $10, $25, or even $50 copay are quickly becoming a thing of the past. Here’s why.

Over the past two years, health care costs have increased by about 7 percent, while the rate of inflation has held steady at about 1 percent. In other words, health care costs (prescription drugs, hospital stays, and high-tech imaging) are far outpacing any other segment of the American economy, including wages. To combat these trends – and keep insurance premiums affordable – more and more employers are opting for high deductible health plans.

According to the Commonwealth Fund, 34 percent of people who receive health insurance through their employer have a high deductible of $1,000 or more. What this means is these folks pay $1,000 out of pocket (not including their premium) before their health insurance kicks in. Once the deductible is met, the health insurer picks up the tab or a percentage of it.

One of the most important features of a high deductible plan is a health funding account. These accounts, which come in several different formats, are oftentimes deducted from your paycheck tax-free and can be used to pay for most medical expenses. This means that if you take an expensive drug or know you need a knee replacement, you can plan ahead.

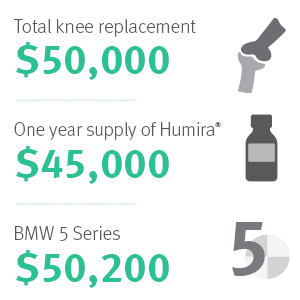

Speaking of planning ahead, you wouldn’t purchase a house or car without shopping around, would you? Now that you’re footing more of your medical bills, it makes sense to comparison shop. After all, the average cost of a total knee replacement in the U.S. runs about $50,000, and some commonly used prescription drugs, including the wildly popular Humira, cost about $45,000 a year. That’s the same price as a BMW!

The good news is that – if you have health insurance – you won’t ever pay the actual cost of a knee replacement or a one-year supply of Humira. The Affordable Care Act set an out-of-pocket maximum of $6,850 for individuals and $13,700 for families. I understand that’s a lot of money for any family to afford. That’s why it’s critically important for folks to start planning ahead.

Unfortunately, shopping for cars is a lot easier than shopping for health care services. Just think of all the websites that cater to cost-conscious consumers. From Autotrader to Travelocity, it’s not difficult to find a good deal on a vehicle or vacation. Try doing the same for an X-ray.

As more and more consumers opt for high deductible health plans, it is imperative that our industry evolve and provide them with the information they need to manage their health care households. A number of health insurers – including CDPHP® – are diligently working to find solutions, but we need to work harder and faster.

In the coming weeks, you will likely see headlines suggesting that insurance premiums are rising again. It’s important for consumers to understand that insurance premiums are a reflection of growing health care costs. Nothing more. While we work to find solutions to lower drug costs and make hospital stays more affordable, it’s important for consumers to get into the driver’s seat and take control of their health care households.

The Daily Dose

The Daily Dose

Comments are closed.