The True Cost of Health Care

The Affordable Care Act (ACA) has changed how many New Yorkers approach health care. We may begin asking ourselves how we can minimize our health care costs while still getting the best care money can buy? In essence, what is the true cost of health care? (And why does insurance cost what it does?) Let’s look at where your premium dollars go.

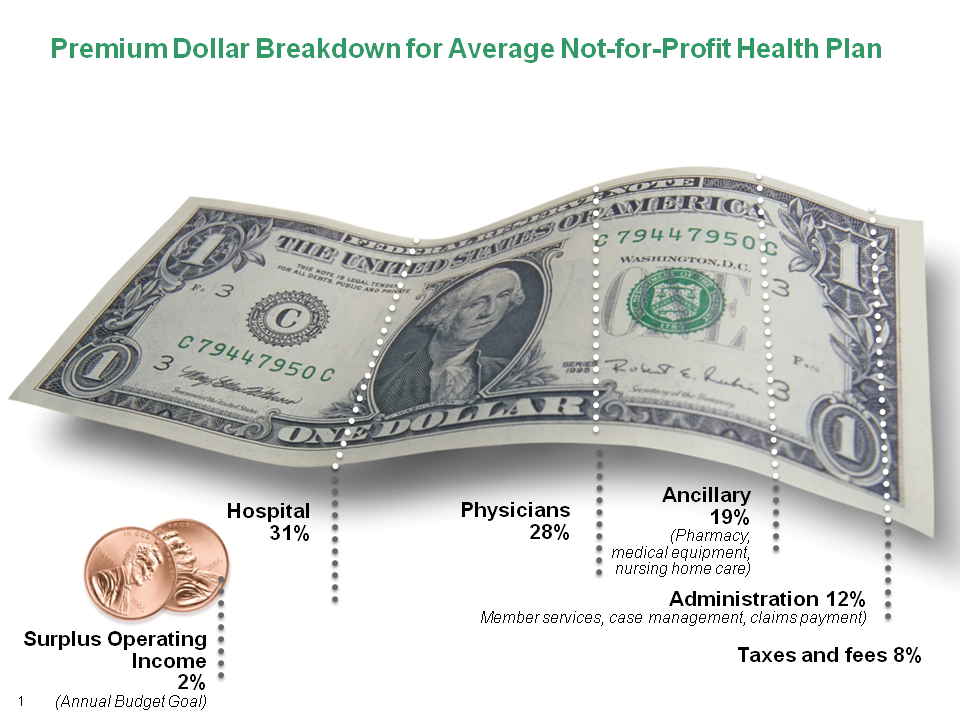

Nearly 60% of the 3.5 trillion dollars spent on health care in 2013 went directly to physicians and hospitals. Another 20% went to prescription drugs, medical equipment, nursing homes, and continuing care. That left 12% for health insurance administration, and another 8% for taxes and fees.

A closer look reveals that the amount of money we’re paying hospitals and physicians is increasing at a rate greater than inflation. Combine that with the fact that in addition to the added benefits and services required by the ACA, the law also introduces new taxes and fees that will contribute to health care costs. A study by global management consulting firm Oliver Wyman indicated that over ten years, there will be close to a $10,000 per family impact as a result of the ACA’s taxes and fees.

What does all this mean for you? Well, you may not be able to control the taxes and fees that are being imposed, but you can have greater control over your health care spending choices.

Wasteful spending

According to the Institute of Medicine (IOM), wasteful spending accounts for about half of all U.S. health care expenditures. That means that patients are undergoing unnecessary tests and procedures – and they are not getting better outcomes as a result. So is that really money well spent?

How to get the most from your health care dollars

The situation is not bleak, however. The ACA is creating an environment that engages consumers and educates them about the costs of their health care. And we’re here to help by providing key steps you can take to get the most from your health care dollars:

- Be informed. The ACA has established new regulations for insurers that can expand your benefits and coverage, including no-cost preventive health services and screenings, coverage for pre-existing conditions, and more.

Know about your rights and your coverage!

- Assess your needs. Whether you’re in good overall health or you have a chronic illness that requires frequent doctor visits and various medications, choose a plan that will provide the most value based on your situation.

There are four main factors you should consider when selecting a health plan:

Cost of the annual premium

Type of benefits offered

Out-of-pocket expenses

Eligibility for tax credits and subsidies under the ACA

- Look for ways to save on prescription drugs. The CDPHP Rx Corner gives you guidelines for finding discounts on the medications you need. With our Rx for Less program, members with prescription drug benefits can get 100 pills for as little as $1 at participating pharmacies.

- Take advantage of your benefits. You’ve heard the saying that “an ounce of prevention is worth a pound of cure.” Experts say that consumers who use services now provided under the ACA at no cost to the consumer – well-child visits, cancer screenings and more – are saving more money than those who don’t. Check out some of the benefits of CDPHP membership.

- Question the necessity of tests and procedures. While it might feel awkward to ask your doctor about the value of a blood test or X-ray that is being recommended, do it anyway. Often, doctors will recommend a test just to confirm what they already know. Ask your provider if the test, procedure, or follow-up visit is really necessary.

Chances are, you wouldn’t buy a house without researching the neighborhood. Apply the same logic to your health care costs. Look at what you need, what you want, and which plan best fits your lifestyle and medical concerns. Don’t be afraid to ask the hard questions – your health care costs are in your hands.

The Daily Dose

The Daily Dose

Comments are closed.