Get an Instant Quote

Let us help you find the group health plan that’s right for your business.

Learn more

What’s the most expensive benefit in your company’s compensation package? If you’re like most small business owners, your answer is health insurance. It’s also the most valuable benefit to your employees.

In fact, according to a September 2021 SHRM Benefits Survey, 90% consider health care benefits as extremely or very important.

So, it’s important to make wise decisions about your group health insurance plan – the familiar type of policy that can cover all of your organization’s eligible employees – and, in many cases, their spouses, children, and cohabiting partners.

Under existing Affordable Care Act (ACA) rules, companies are not required to provide health insurance to their employees. But the law guarantees small employers (with two to 50 employees) access to group health insurance plans if they want them. It also offers tax credits to help small businesses cover a portion of these plans if they meet specific criteria.

The government may penalize larger companies (50+ employees) if they meet certain criteria but don’t provide coverage.

Finding an adequate and affordable group health insurance plan can be challenging and time-consuming. Choices that seem efficient in the short term may be costly or frustrating for the company or your employees in the long term.

Five of these mistakes are below—along with suggestions to help you avoid them.

Engaging employees in the selection process early can help you get a sense for the group health insurance plan that will best meet the specific needs of the greatest part of your team. It also helps explain your premiums, which reflect the eligible employees within your organization.

You might also take an anonymous poll of your employees before you speak with potential insurers. This increases transparency and helps your employees understand some of the factors you have to evaluate. Among other things, you can ask them:

Even after you’ve made your selection, remember to communicate with employees about why you chose that plan, so they know that you took their wishes into consideration.

The Society of Human Resource Management (SHRM) provides a useful and impartial roundup of resources to help you with these tasks.

Especially in such a time of cost-consciousness around health plans, it can be tempting to focus only on the dollars and cents. However, according to one industry study:

Let us help you find the group health plan that’s right for your business.

Learn moreStriking the right balance goes far beyond the health plan. In the same study, 80 percent of employees said the benefits package affects their decision to remain with a company. In another study, 80 percent of companies said they weighed the effects on employee retention when they selected health insurance.

This is truly a situation in which you often get what you pay for. As a benefits administrator, you may decide that the least expensive plan is adequate for your employees’ daily lives. But lower-cost group health insurance plans often lack sufficient coverage—or require astronomical copays and coinsurance—for major health concerns such as a complicated pregnancy, a chronic illness diagnosis or a broken arm. These can derail a family’s finances.

Don’t start your plan comparison with the bottom-line cost. Instead, evaluate the benefits of each plan. Rank them based on:

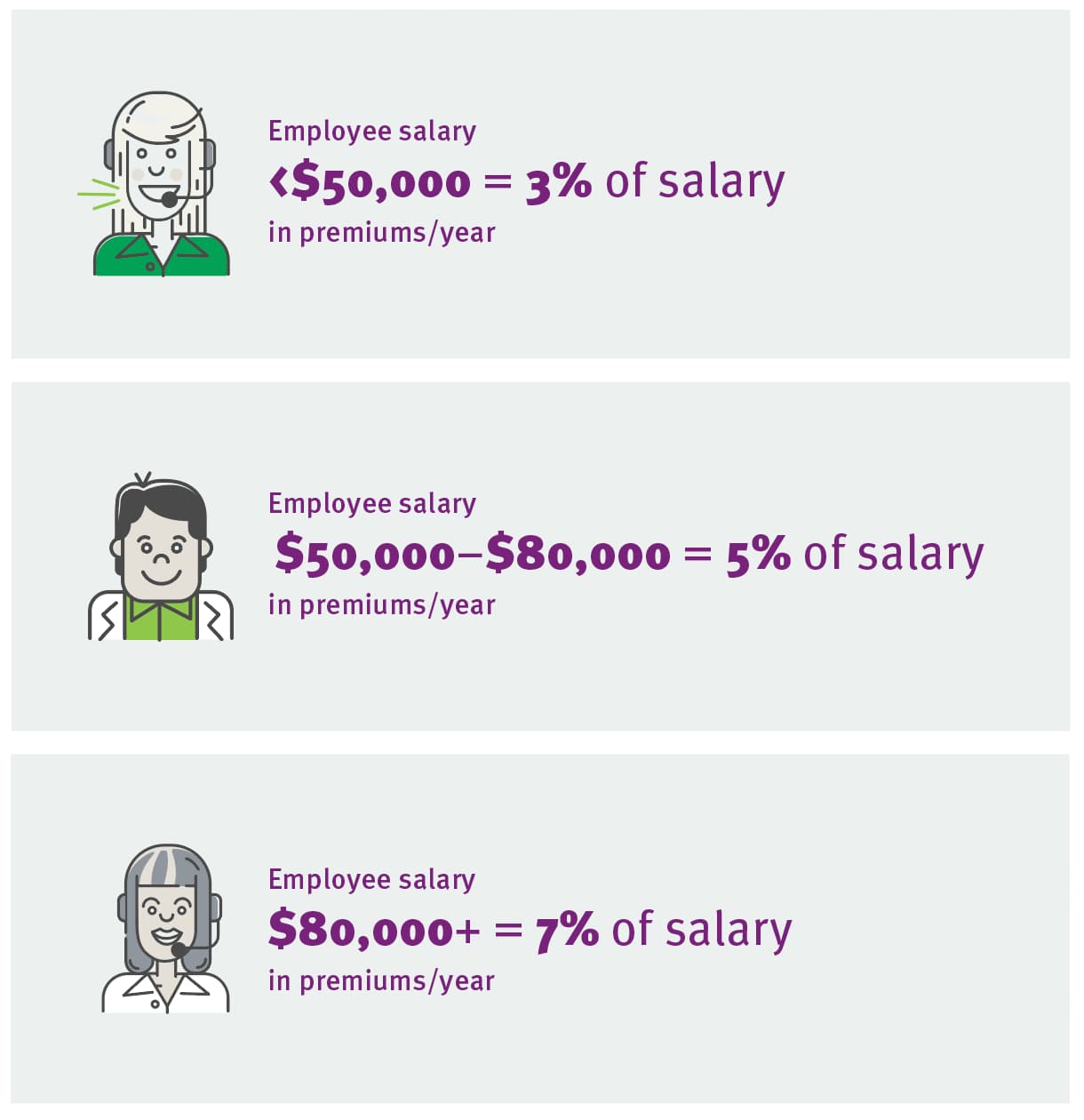

These benchmarks from recent studies will help you plan accordingly:

Also, look over the maximum coverage per claim, per year, and per lifetime—and limitations on certain conditions.

Nearly all health plans provide convenience and preventive health perks in addition to standard coverage. Many people don’t take advantage of these offers, though.

A healthy workforce may require less medical intervention, which can help control your company’s group health insurance premiums from year to year.

CDPHP® leads the Capital Region with its comprehensive offerings, which includes all of the extras above—and more. Our CDPHP Customer ConnectSM locations even welcome community members to drop by and get questions answered by a knowledgeable member relations specialist.

As you look at the costs of group health plans, remember that not every expense is equal. In fact, choosing the right plan can help you and your employees save money to offset its cost.

Your company’s contributions toward a group health insurance plan are tax-deductible as a business expense. Plus, your employees’ premiums are paid from pre-tax wages, which may lower your payroll taxes. Some small businesses may also have access to tax credits.

You may also choose to offer a funding account to help your employees pay for health care expenses. These also have tax benefits for your company—as well as your employees. Each one functions differently and has different requirements:

Health Reimbursement Account (HRA)

Health Savings Account (HSA)

Flexible Spending Account (FSA)

Employees may also lower their taxes when they use pre-tax dollars to pay their health insurance premiums and funding account contributions. These payments reduce their net income, on which income taxes are based.

It’s important to remember the ACA employee affordability requirement. As per IRS Rev. Proc. 2022-34:

If you find two similar, well-constructed, comprehensive group health insurance plans, but one is priced much lower, take a look at the company’s customer service reviews.

There are a few ways to do that:

Customer service is something you and your employees hope you never need. When you do, though, it’s guaranteed to be urgent and important.

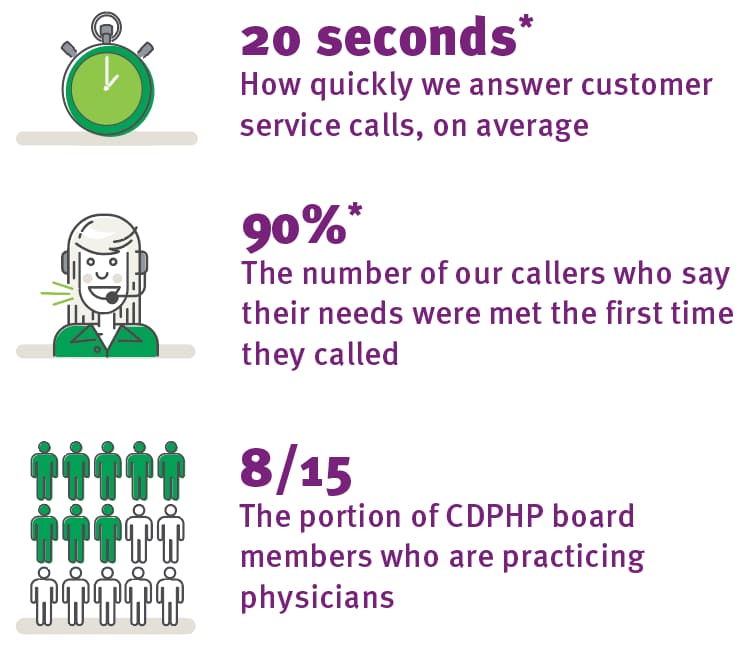

At CDPHP, we’re proud to be able to say:

*Results above are a blend of all commercial products January – August 2022 (HMO, CDPHP UBI, Health Funding, Self-Insured)

An insurance company’s network of providers is another signal of quality. Under each plan you’re considering, look for:

Especially in rural areas, there may be only one convenient option for urgent care or lab work nearby. Your employees will thank you for ensuring it’s in the network you choose.

In New York’s Capital Region, CDPHP has a reputation for excellence. CDPHP health plans are among the highest-rated, both in New York State and around the country, by NCQA (NCQA Health Plan Ratings 2022).

All CDPHP health plans are ACA-compliant and those with MagnaCare/First Health provide access to a national network of 1,000,000+ providers. They make it easy for you to avoid making the mistakes above.

Our group health insurance plans include:

Let us help you find the group health plan that’s right for your business.

Comments are closed.