Heading to college? Know your health insurance options

Whether you’re a college student, a high school senior, or a parent, you should know your options when it comes to health insurance. Most college students lead an active lifestyle, and being uninsured is not an option.

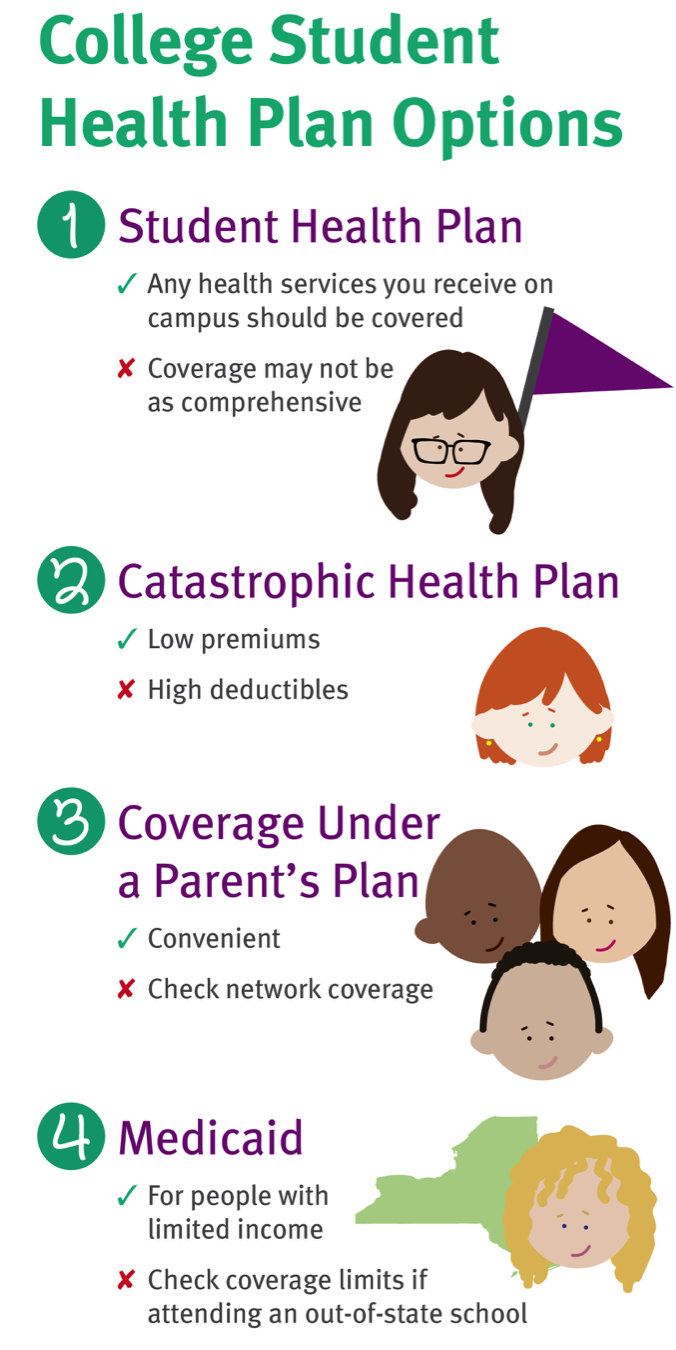

College student health plan options

- Student health plan: You may be able to choose coverage through your school’s health plan, which may satisfy the ACA’s requirements. One benefit to using your school’s plan is that any health services you receive on campus should be covered. However, if you require care from certain specialists or if you are hospitalized, the coverage may not be as comprehensive.

- Catastrophic health plan: If you’re younger than 30, you could buy a catastrophic health plan. These usually have lower premiums and high deductibles. A deductible is what you pay out of pocket for care, up to a certain amount. When you reach the specified amount, the insurance company pays all or a percentage of covered services. Catastrophic plans work for worst-case scenarios like accidents or serious illnesses. They also include preventive care services, like vaccines and primary care visits, as required under the ACA. However, you’ll pay out of pocket for more routine illnesses like strep throat, mononucleosis, the common cold or flu, or other ailments that are prevalent in college environments.

- Coverage under a parent’s plan: If you’re eligible for coverage under your parent’s plan, check to see how many network providers are located in the area where you attend college. If your school is out of state or out of the country, our Coast-to-Coast Coverage works the same as if you’re traveling on vacation.

- Medicaid: When you apply through the NY State of Health marketplace, you can find out whether you qualify for Medicaid, a state program for people with limited income. You can enroll in Medicaid anytime throughout the year. If you already have Medicaid benefits, check your coverage limits before you enroll in an out-of-state college.

If you chose a health plan through your college, you are likely covered under the Affordable Care Act (ACA). This means that you don’t have to pay the penalty that other people who don’t have coverage pay. Check your plan to see if it qualifies under the ACA. You may also be eligible for a lower cost plan through the NY State of Health® marketplace based on your income. You can get premium estimates for your coverage and find out whether you qualify by answering a few questions.

Coverage under a parent’s plan until age 26

A parent can keep a child on his or her plan until the child turns 26. Dependents can remain on the parent’s plan even if they’re married, live outside the parent’s home, attend school, are financially independent, and are eligible for an employer’s health insurance plan.

Happy 26th birthday!

Under-26 coverage ends when a child reaches age 26. However, a Special Enrollment Period enables the child to enroll in a health plan outside the normal open enrollment period. He or she can also enroll up to 60 days before a 26th birthday, but the special enrollment period will end 60 days after his or her 26th birthday. If the child does not enroll within 60 days, he or she may not be able to get coverage until the next open enrollment period. This also means that he or she may have to pay the uninsured person’s fee, unless the no coverage period is under three months in a calendar year. Check out these FAQs for more information about this process.

The entire college experience is an exciting time. In addition to attending classes and planning for your future, make sure that you also take care of your health coverage. Have a great year!

The Daily Dose

The Daily Dose

Comments are closed.