Making the Most of Your High-Deductible Health Plan

After years of historically slow growth, new figures show that health care spending jumped five percent last year, the largest increase since 2008. The rising cost of care has employers and individuals alike looking at creative ways to control spending. One of the most popular trends is high-deductible plans.

How High-Deductible Plans Work

High-deductible plans, which many believe promote a more cost-conscious consumer, generally consist of lower premiums (monthly bills) and higher out-of-pocket expenses. As health care consumers adjust to this new reality, it’s important for people to know how to make the most of their high-deductible plans.

With a high-deductible plan, the member is responsible for paying a certain amount of money out of pocket before his or her insurance kicks in. Once the deductible (which varies by plan) is met, the health plan picks up the tab or a percentage of it.

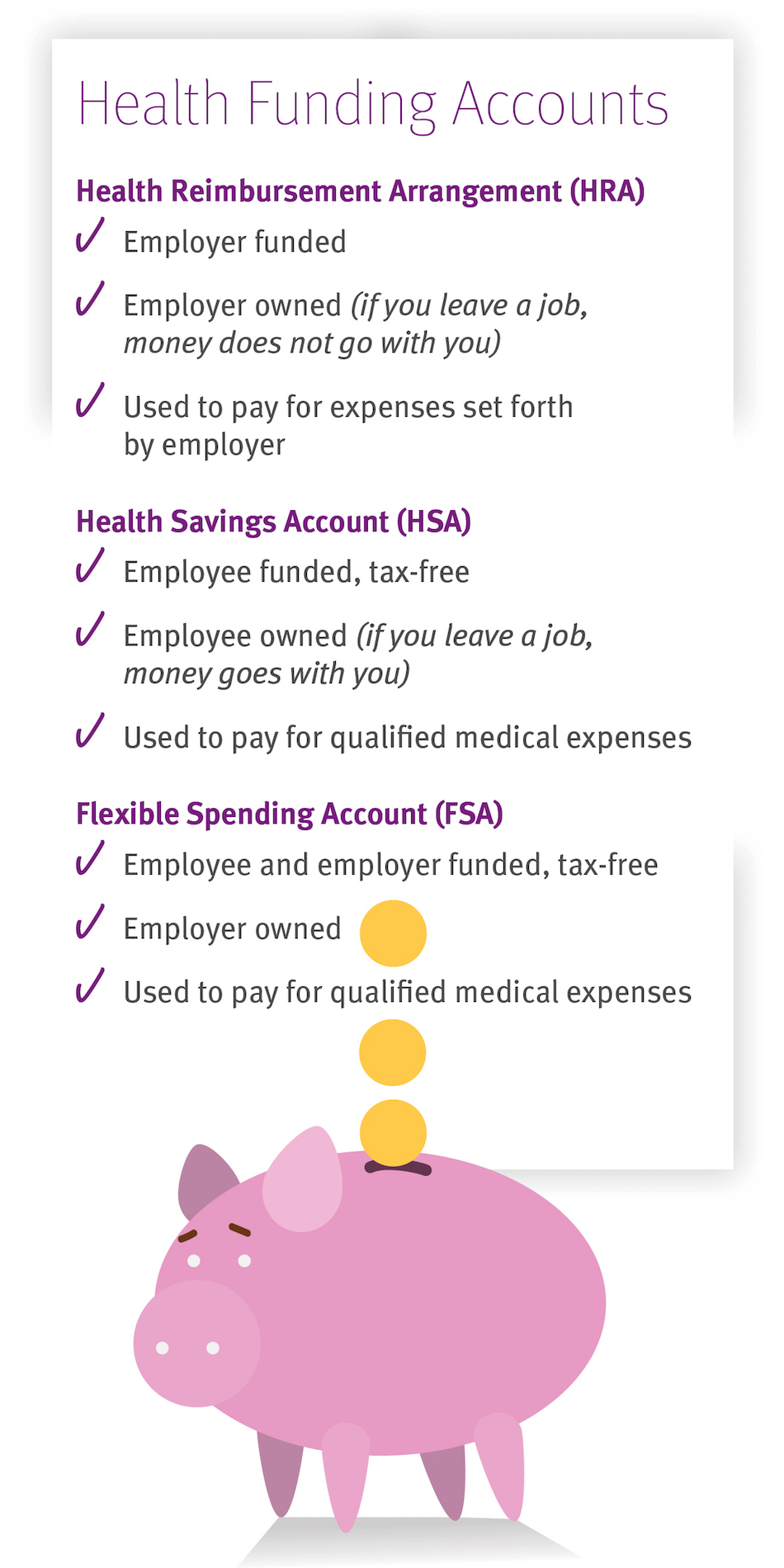

One of the most important features of a high-deductible plan is a health funding account, which is generally used to pay for copays, vision and dental care, prescriptions, and other qualified medical expenses. See the accompanying chart to learn more about the three types of health spending accounts.

The Path to Greater Cost-Consciousness

High-deductible plans require members to assume more financial responsibility, so consumers are compelled to pay more attention to the cost of care, and hopefully, make more cost-conscious decisions. A recent study by Health Care Services Corporation found that consumers enrolled in high-deductible plans were four percent more likely to take advantage of preventive services, had a 12 percent decrease in emergency room visits, and were 10 percent more likely to fill their prescriptions with generic drugs. These advantages have not only been noticed by individual consumers, but among employer groups as well. Data shows that employers that offered only high-deductible plans saw a 14 percent reduction in health care spending over three years after switching from a traditional plan.

Not everyone is convinced, however. A survey by EBRI/Commonwealth Fund found that individuals with more comprehensive health insurance were more satisfied with their plans than those with high-deductible plans. The same study also showed that individuals with high-deductible plans were more likely to avoid, skip or delay health care because of costs. That’s despite the fact that most high-deductible plans are required to cover preventive services (such as annual exams, vaccinations and screenings) at no out-of-pocket expense.

Many employers are turning to high-deductible plans as a way to tighten the belt. In 2014, 25 percent of employers offered a high-deductible product as an option for their employers, while 46 percent said it would be the only choice in 2015.

For some, it’s easy to see the financial benefits of switching to a high-deductible plan. But, for many Americans, particularly those who are not used to managing their own health care dollars, the change is not easy. To be successful, health plans must empower consumers with the tools and information they need to make the most informed decisions. Government needs to ensure that providers are offering more cost transparency. If and when these efforts are successful, we should see an improvement in our members’ well-being, which is the true heart of the health care system.

The Daily Dose

The Daily Dose

Comments are closed.