New Year, Same Old Problems

State lawmakers are back at the Capitol for a legislative session, which will likely be dominated by budget talks. And with health care being a major subject of debate in every legislative session, I am pleading with policymakers to keep affordability at the forefront.

Here’s why …

Each year, state and federal lawmakers pass dozens of laws that are well-intentioned, but often lead to higher costs. As a result, 7 cents of every dollar you spend on health insurance goes directly to the government, not for care, but for taxes, fees, and assessments. If that doesn’t sound like a lot, let me break it down in dollars and cents.

Health Care Reform Act (HCRA) Tax

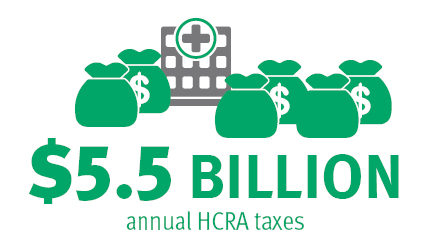

Twenty years ago, New York state passed the Health Care Reform Act (HCRA), with the goal of ending state-imposed price controls on hospitals. The law’s intentions were good but it levied a hefty tax on health insurers and consumers to – in part – pay for the charity care that hospitals provide. Over the past two decades, HCRA taxes have ballooned to a whopping $5.5 billion a year and now rank as the third-largest tax in the nation’s highest-taxed state.

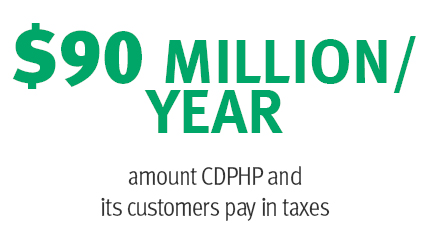

So what does that mean for a small, not-for-profit health plan like CDPHP®? Last year, CDPHP and its customers paid more than $45 million in HCRA taxes. That’s a scary number when you consider the continuous increase in health care costs.

Health Insurance Tax

Then there’s the health insurance tax (HIT), a $100 billion-plus federal sales tax the government kindly calls “an annual fee on health insurers.” The tax, imposed as part of the Affordable Care Act, is expected to increase the cost of insurance premiums by $7,000 over the next 10 years. In fact, the Congressional Budget Office said the HIT is “largely passed through to consumers in the form of higher premiums.”

The HIT will mostly impact the nation’s small businesses, as the National Federation of Independent Business says the tax will reduce private sector employment by about 200,000 jobs, 60 percent of that falling on small business. For CDPHP, the health insurance tax amounts to $27 million per year.

Covered Lives Assessment

Next up, let’s talk about a little (not so little) thing called the “covered lives assessment.” This state-based tax is an annual surcharge levied on health plans and is based on the number of people they insure. Created in 1996, the tax was intended to pay for graduate school medical expenses, but over time, it has been used for general funds. Last year, the state collected about $1 billion from New Yorkers in the form of the covered lives assessment. At CDPHP, this added up to just over $8 million.

Dizzy yet?

I could keep going, but I think you get the point. The number of taxes, fees, and mandates jacking up the cost you pay for health care is seemingly endless. The above-mentioned mandates were all well-intentioned, but were not designed to address the single-biggest problem facing our nation’s great health care system. The cost of health care is simply too high, and before lawmakers move forward on any health care-related legislation, I am imploring them to guarantee New Yorkers that they won’t once again increase the cost of their care.

The Daily Dose

The Daily Dose

Comments are closed.