The ABCs of Medicare

The year you turn 65 is an exciting time of life! It’s also the year you get to enroll in Medicare. Maybe you’re newly retired and making plans for travel, volunteering, or babysitting the grandkids. Maybe you’re postponing retirement because you’re still full of enthusiasm for your job. Maybe you’re not sure what lies ahead, but you’re determined to make these years your best yet!

This is also the time to make sure your health insurance can keep up with your lifestyle. Medicare coverage can be just as robust as the insurance you had through your job or that you bought on a health exchange, and it’s important to understand your options and enrollment deadlines to make sure you get the coverage that’s best for you.

Let’s start with the basics

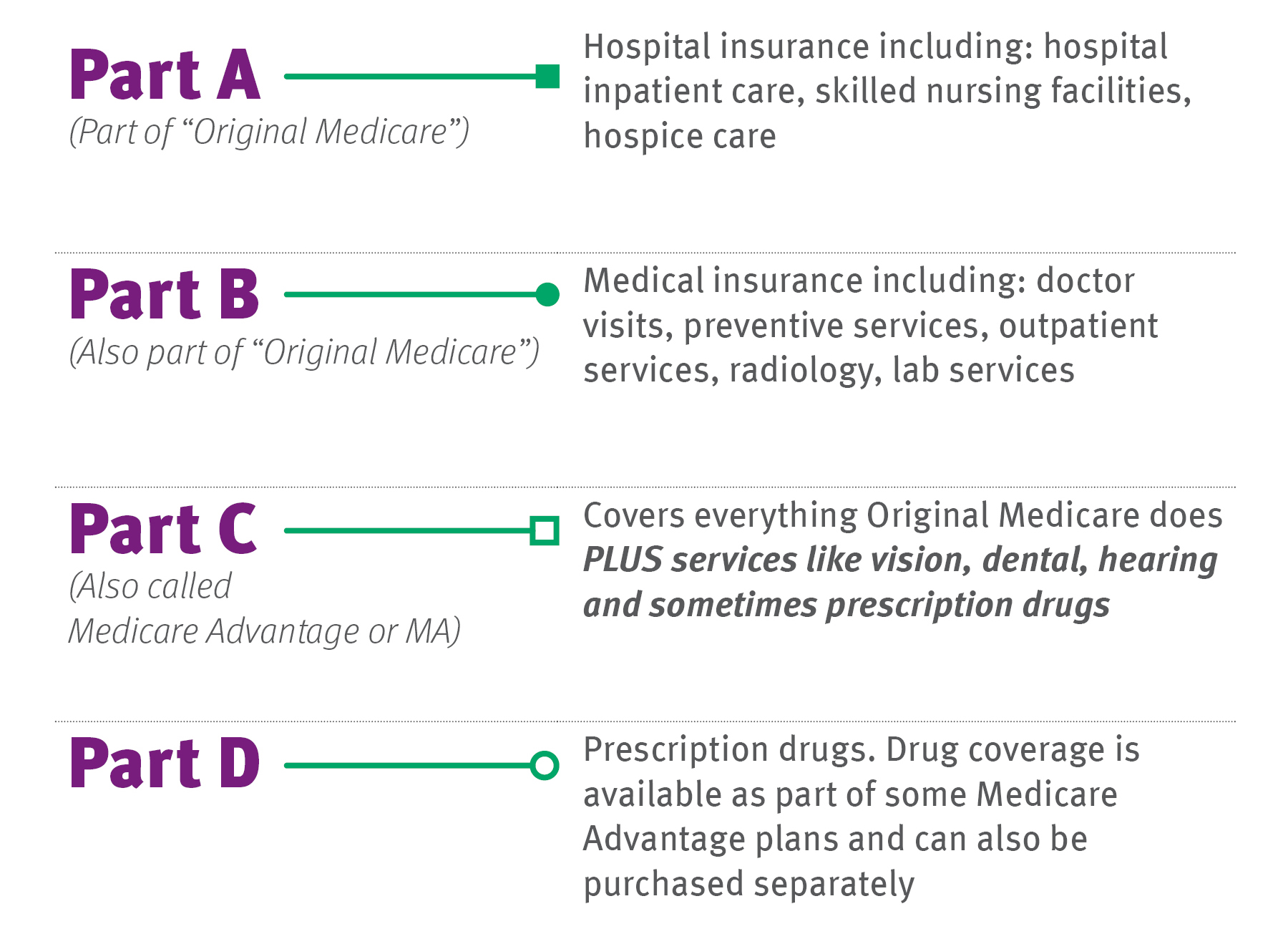

Original Medicare is provided through the federal government (the Center for Medicaid and Medicare Services—CMS), and has two parts: Part A (hospital coverage including hospital inpatient care, skilled nursing facilities, and hospice care) and Part B (medical insurance including doctor visits, preventive services, outpatient services, radiology, and laboratory testing).

Medicare Advantage (Part C) is offered through private insurance companies (like CDPHP) and covers everything Original Medicare does plus things that Original Medicare doesn’t. Medicare Advantage plans often include vision, dental, and hearing coverage. Some plans also include prescription drug coverage (Part D).

Medicare Advantage plans can also include no-cost extras like wellness programs, access to exclusive online health resources, and fitness classes.

Part D is prescription drug coverage. You can buy a Part D plan by itself, but this coverage is often included in a Medicare Advantage plan.

So now that you know the lingo, here are answers to other common questions:

When should I enroll in Medicare?

The first time you sign up for Medicare is called the initial enrollment period (IEP). You have a seven-month window to enroll: the three months before the month you turn 65, your birthday month, and the three months after your birthday month. If you don’t enroll during this time, you may have to pay penalties.

Okay, so how do I sign up?

You can get Original Medicare coverage by contacting the Social Security Administration. You can get Medicare Advantage by contacting an insurance company directly.

What if I have a Medicare Advantage plan and I want to switch?

You can switch plans each fall during the annual election period (AEP). This period generally runs from October 1 to December 7.

In certain circumstances, you may qualify for a special enrollment period (SEP), which allows you to make a change outside of AEP. Contact us to see if your circumstance qualifies.

What if I have a Medicare Advantage plan that I love and want to keep?

This is easy! Do nothing! If you have a CDPHP Medicare Advantage plan, we’ll renew your plan automatically and will send you updated plan information.

Still have questions? Attend a seminar or give CDPHP a call at (518) 641-3400 or toll free 1-888-519-3364 (TTY/TDD: 711).

Our hours are Monday–Sunday, 8 a.m. to 8 p.m. from October 1 through February 14; and 8 a.m. to 8 p.m. Monday–Friday the rest of the year.

You can also compare our plans and enroll online. CDPHP offers a wide variety of plans to meet all needs and budgets, including a new $0 Medicare plan with no monthly premium.**

**You must continue to pay your Medicare Part B premium. This information is not a complete description of benefits. Contact the plan for more information.

The Daily Dose

The Daily Dose

Comments are closed.